Stop Losing Money. Start Winning Trades.

Algomaxx Smart Pro combines advanced technical algorithms to identify high-probability trading opportunities with precise entry/exit points, trend analysis, and risk management – all in one powerful, easy-to-use indicator.

Get AccessSmart Signals

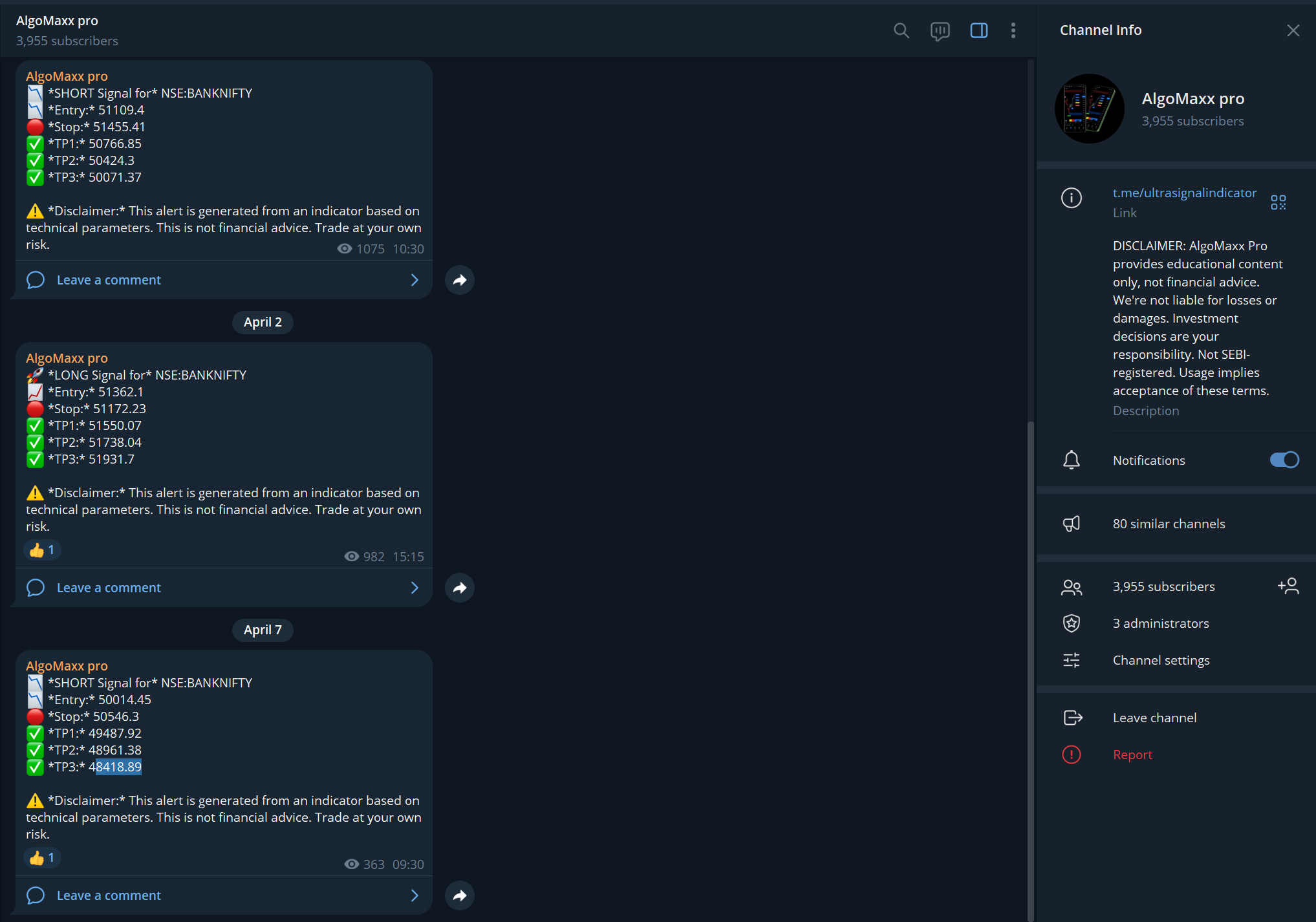

Get precise buy/sell signals with built-in stop-loss and take-profit levels for optimal risk management.

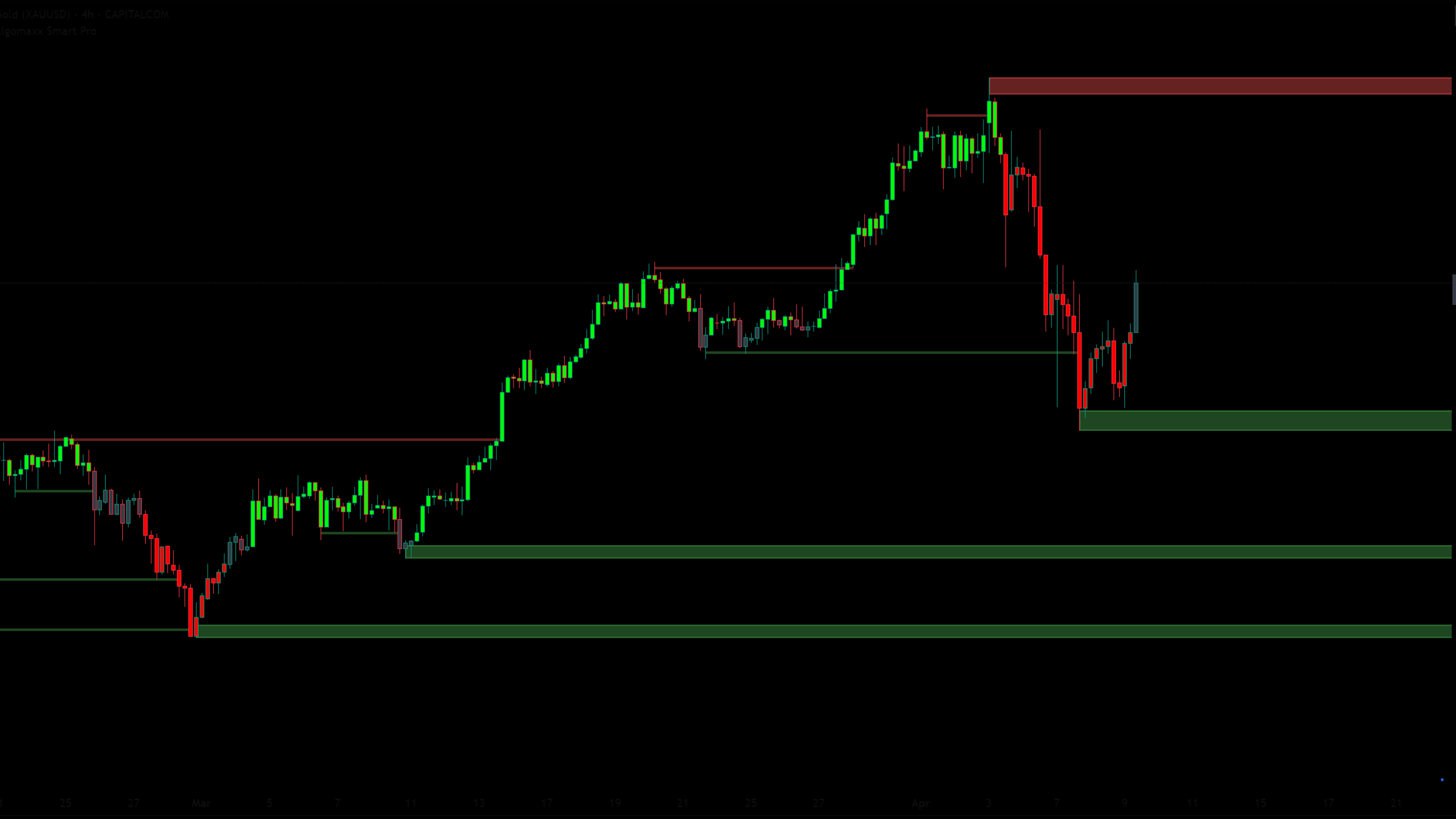

Supply/Demand Zones

Identify key market levels where institutional money is likely to act and react.

Multi-Timeframe Analysis

View trend alignment across 5 timeframes to find the strongest trade setups.

Custom Alerts

Never miss a trading opportunity with customizable alerts for entries, exits, and breakouts.

Stop Making These Costly Mistakes

Our AI-powered system helps you avoid the most common trading pitfalls.

Emotional Trading

78% of traders fail due to emotional decisions driven by fear and greed, leading to impulsive entries and exits.

The AlgoMaxx Solution

- AI-powered signals remove emotions from trading decisions

- Automated signal validation based on multiple factors

- Professional risk control with precise SL/TP levels

Missed Setups

Traders miss up to 70% of profitable opportunities due to manual analysis limitations and information overload.

The AlgoMaxx Solution

- Constant market monitoring across multiple timeframes

- Real-time alerts for trade entries and exits

- Clear visual signals that are impossible to miss

Poor Risk Management

90% of traders blow their accounts by not managing risk, with improper position sizing and stop-losses.

The AlgoMaxx Solution

- Dynamic stop-loss levels based on market volatility

- Triple take-profit targets for strategic exits

- Automatic calculation of optimal risk:reward ratios

Powerful Features

Everything you need to succeed in today's volatile markets

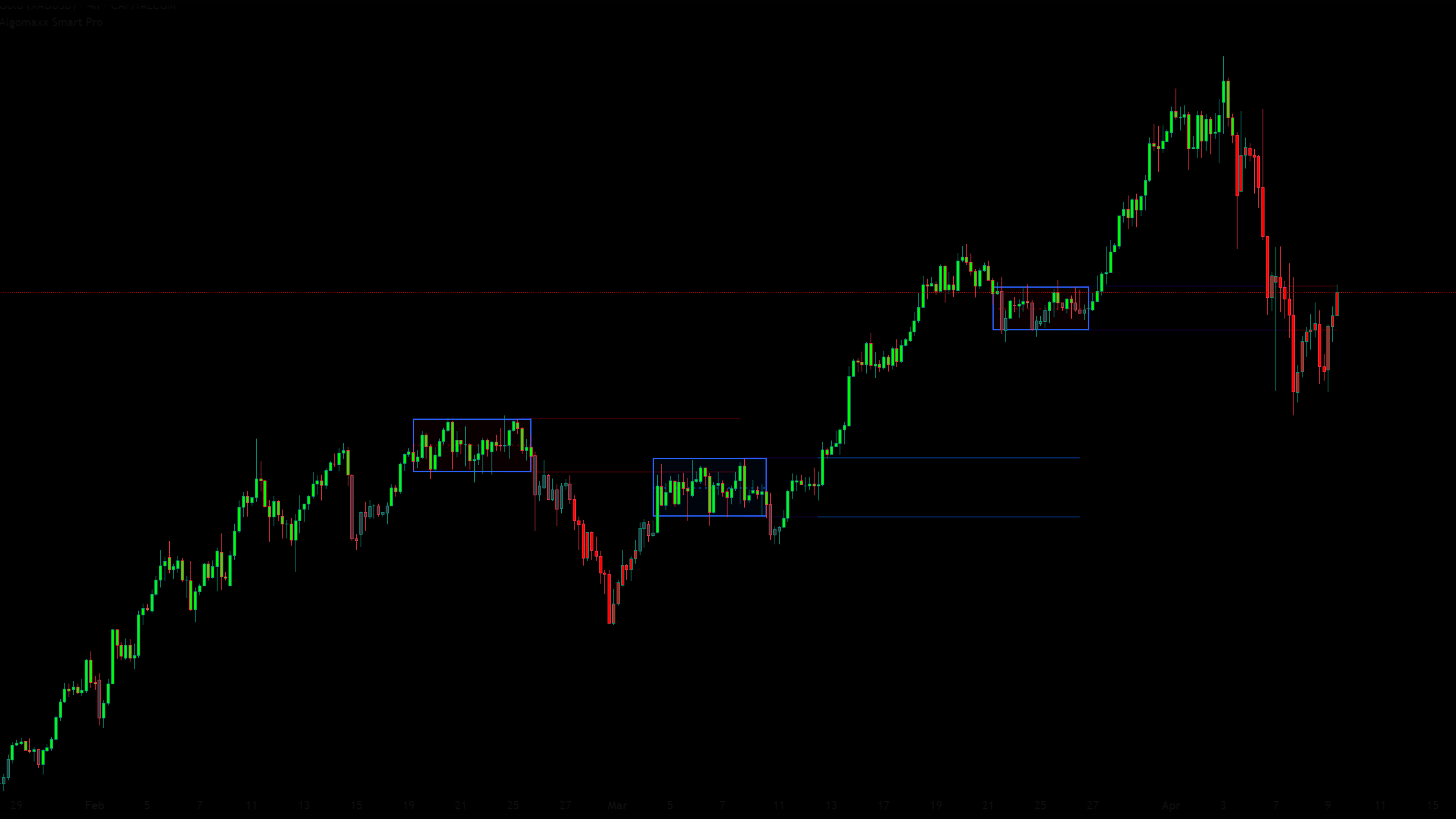

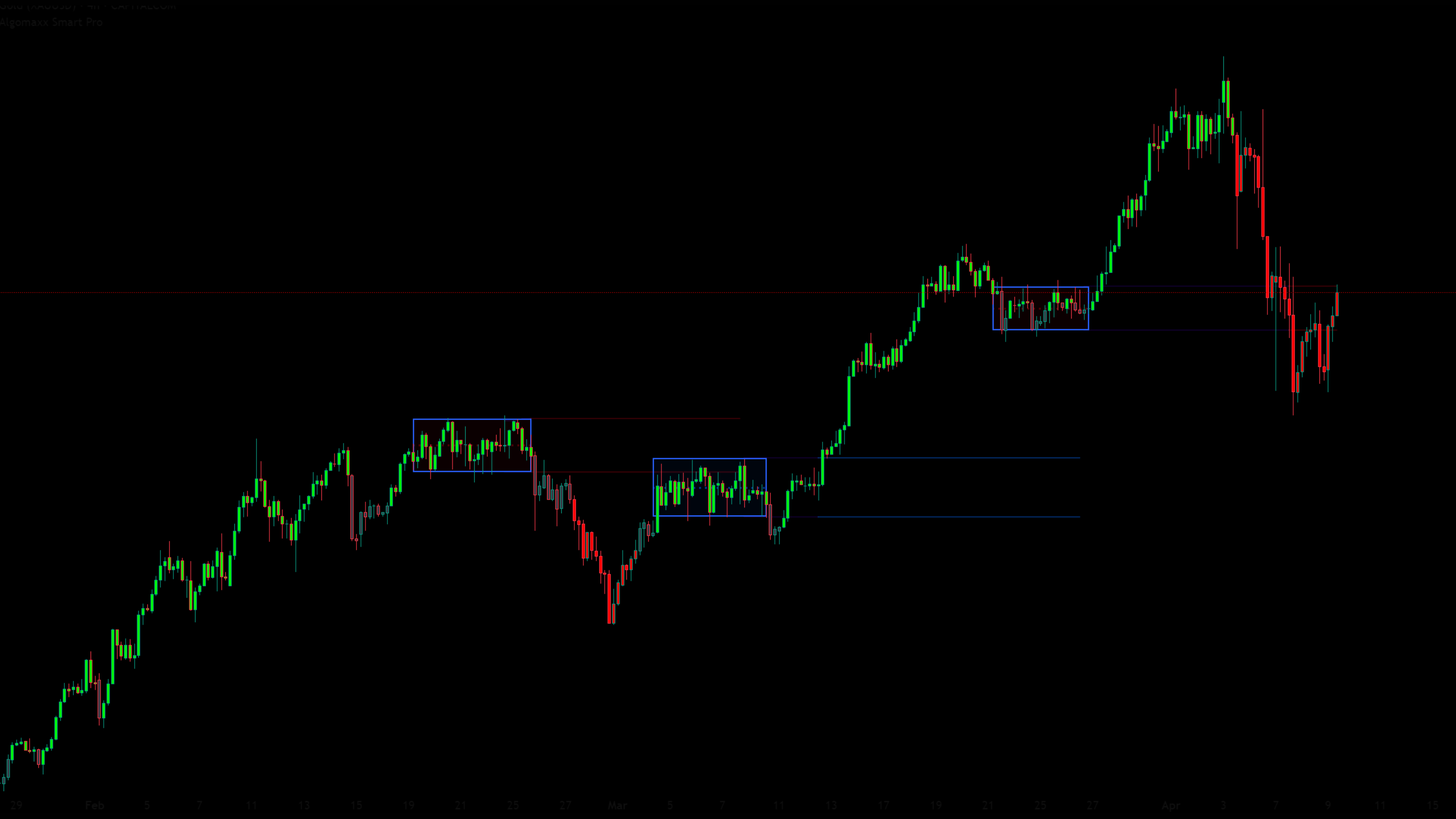

Precision Trading Signals

Get clear buy and sell signals with automated stop-loss and triple take-profit levels calculated with advanced ATR-based algorithms.

Dynamic Market Structure

Identify key supply and demand zones, trendlines, and Fibonacci levels to understand where the market is likely to react.

Multi-Timeframe Analysis

Analyze trends across 5 timeframes simultaneously to confirm signals and identify the strongest setups.

Trend Strength Visualization

Visual trend ribbons and cloud indicators that show trend strength and direction at a glance, helping you stay on the right side of the market.

Range Detection

Automatically identify range-bound markets and generate alerts when price breaks out, allowing you to capitalize on high-momentum moves.

Currency Strength Meter

Track the relative strength of major currencies to find the strongest trends and best trading opportunities in the forex market.

Automated Fibonacci Levels

Automatically calculates and displays key Fibonacci retracement levels based on recent market swings.

Dynamic Trendlines

Smart algorithm automatically draws and updates trendlines based on significant pivot points.

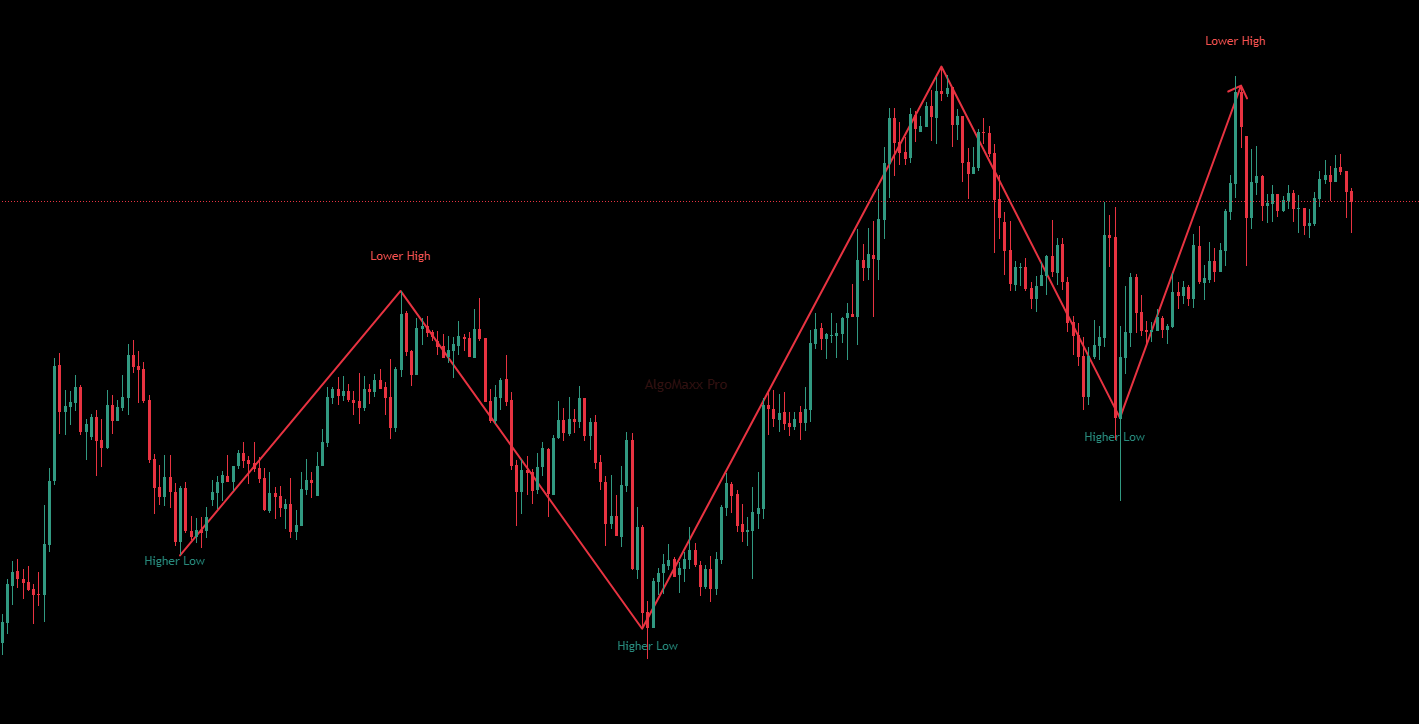

Swing High/Low Detection

Automatically identifies key swing points in the market with "HH", "HL", "LH", and "LL" labels.

RSI Oversold/Overbought

Identifies potential reversal points with automatic RSI analysis, highlighting overbought and oversold conditions.

EMA Cloud System

Proprietary EMA cloud visualization that offers clear trend direction confirmation with color-coded zones.

Comprehensive Alerts

Receive customizable alerts for trade entries, exits, trendline breaks, range breakouts, and more.

Information Dashboard

View all critical information in a clean, customizable dashboard for quick decision making.

Cross-Platform Compatibility

Works seamlessly within TradingView, accessible on any device including desktop, tablet, and mobile.

Supply & Demand Zones

Automatically identifies and highlights key supply and demand zones where institutional trading activity is likely to impact price.

Detailed Feature Breakdown

Deep dive into Algomaxx's powerful capabilities

Smart Trading Signals & Risk Management

Algomaxx Smart Pro generates high-probability buy and sell signals based on a sophisticated multi-factor algorithm. Each signal comes with precise entry points and automated risk management levels.

- Customizable ATR-based stop-loss calculation

- Triple take-profit targets (TP1, TP2, TP3) for strategic profit-taking

- Adjustable Risk:Reward ratio (default 1:3)

- Signal strength filter (Fast, Medium, Slow) for different trading styles

- Visual entry/exit markers on chart with price labels

- Non-repainting signals based on confirmed price action

Multi-Timeframe Trend Screener

Analyze trends across multiple timeframes simultaneously with Algomaxx's advanced trend detection system, ensuring you're always aligned with the dominant market direction.

- 5-timeframe analysis (1m, 5m, 15m, 1h, 4h) in a single view

- Color-coded bullish/bearish indicators for each timeframe

- Instant visual confirmation of trend alignment

- Trend strength indicator showing momentum force

- Custom alerts when trends align across timeframes

- Ideal for finding high-probability entries with trend confluence

EMA Cloud System & Multiple EMAs

Our proprietary EMA Cloud system provides clear trend direction and potential reversal zones, while multiple EMA lines help identify dynamic support/resistance levels.

- Visual 'EMA Cloud' for instant trend direction confirmation

- Multiple customizable EMA periods (8, 21, 50, 100, 200)

- Color-coded EMAs for easy trend identification

- EMA crossover signals for trend change confirmation

- Trend ribbon visualization with customizable colors

- EMA confluences highlight key trading zones

Supply & Demand Zone Detection

The indicator automatically identifies and highlights key supply and demand zones where institutional buying or selling pressure is likely to impact price action.

- Automatic detection of swing high and low zones

- Visual color-coding of supply (selling) and demand (buying) areas

- Adjustable zone parameters for different timeframes

- Visual breakout alerts when price enters key zones

- Historical zone tracking for pattern analysis

- Overlap detection to prevent conflicting zones

Automated Fibonacci Retracement Levels

The indicator automatically calculates and displays Fibonacci retracement levels based on recent market swings, helping you identify potential support and resistance areas.

- Automatic detection of significant high and low points

- Key Fibonacci levels (0%, 23.6%, 38.2%, 50%, 61.8%, 78.6%, 100%)

- Visual markers for 'Fib Top' and 'Fib Bottom'

- Optional table display with price values for each level

- Color-coded visualization based on market direction

- Customizable period for Fibonacci calculations

Automated Dynamic Trendlines

Algomaxx Smart Pro automatically draws and updates dynamic trendlines to visualize the market structure and identify potential reversal points. The intelligent algorithm uses advanced pivot recognition to plot the most relevant trendlines that institutional traders follow.

- Auto-detection of significant pivot points for accurate trendline placement

- Dynamic upper and lower channel lines that update with new price action

- Customizable line style, color, thickness, and extension settings

- Trendline breakout alerts for early trend reversal signals

- Price projection based on channel patterns and trendline extensions

- Internal and external trendlines to identify both immediate and longer-term trends

Auto Swing High/Low Detection

Automatically identify key market structure points with clear labeling of Higher Highs (HH), Higher Lows (HL), Lower Highs (LH), and Lower Lows (LL) for advanced price action analysis.

- Automated detection of significant swing points

- Clear visual labeling (HH, HL, LH, LL) on chart

- Market structure shift alerts for trend changes

- Customizable swing point detection sensitivity

- Pattern recognition based on consecutive swing formations

- Confluence with support/resistance and Fibonacci levels

Range/Consolidation Detection

Automatically identify when markets are in consolidation and generate alerts when price breaks out, allowing you to capitalize on high-momentum moves at the earliest stage.

- Automatic range detection based on volatility patterns

- Visual highlighting of range boundaries

- Color-coded breakout and breakdown signals

- Real-time alerts when price breaks range limits

- Measures range height for potential move projection

- Works in all market conditions and timeframes

Forex Currency Strength Meter

Gain a comprehensive view of major currency strengths to identify the best forex pairs to trade, with real-time relative performance visualization of up to 5 currencies.

- Real-time analysis of 5 major currencies (USD, EUR, GBP, JPY, AUD)

- Visual strength meter with color-coded indicators

- Customizable timeframe for strength calculation

- Cross-pair correlation analysis

- Helps identify strongest trending pairs

- Adjustable dashboard position and appearance

RSI Oversold/Overbought Detection

Algomaxx Smart Pro automatically identifies potentially profitable entry and exit points using an advanced RSI (Relative Strength Index) detection system. The indicator highlights overbought and oversold conditions across multiple timeframes.

- Automatic detection of overbought (above 70) and oversold (below 30) RSI conditions

- Visual color-coded highlights on chart when RSI reaches extreme levels

- Multi-timeframe RSI analysis to confirm signals across different timeframes

- RSI divergence detection for powerful reversal signals

- Customizable RSI period and threshold levels for personalized analysis

- Integration with trend analysis to filter out false signals

Comprehensive Alert System

Never miss a trading opportunity with our robust alerting system that notifies you of key events across all features of the indicator.

- Customizable alerts for trade entries and exits

- Signal confirmation alerts when multiple factors align

- Breakout notifications for ranges and key levels

- Market structure change warnings

- Support for platform-specific alerts (TradingView)

- Optional email and mobile push notifications

Information Dashboard

View all critical information in a clean, customizable dashboard that gives you the complete market picture at a glance.

- Comprehensive market overview in one place

- Current signal status with SLTP levels

- Multi-timeframe trend summary

- Key price levels and Fibonacci values

- Market volatility and range measurements

- Customizable dashboard position and transparency

Smart Trading Algorithm

Watch how Algomaxx combines multiple technical analysis methodologies to generate high-probability trading signals with precise entry and exit points.

Built for Traders Who Want an Edge

Whether you're a seasoned pro or a tech-savvy investor, AlgoMaxx fits your style.

Intraday & Swing Traders

For those who need quick, reliable signals to act on market movements.

Algo Trading Enthusiasts

Leverage AI signals to test and inform your automated strategies.

Technical Analysts

Enhance your analysis with an AI-powered second opinion on chart patterns.

Smart Investors

Make data-driven decisions without being glued to the screen all day.

Ready to Transform Your Trading?

Join thousands of successful traders who have boosted their profits and reduced risk with Algomaxx Smart Pro.

Get Started TodayAffordable Pricing Plans

Choose the plan that fits your trading needs

- Full Access to Algomaxx Pro

- Lifetime Access - No Expiration

- Free Lifetime Updates

- 24/7 Priority Support

- Limited-Time Price - Save 75%!

- Only 37 spots left at this price

- Full Access to Algomaxx Pro

- 30 Days Usage

- Free Updates

- 24/7 Support

- Long-term Savings

- Full Access to Algomaxx Pro

- 365 Days Usage

- Free Updates

- 24/7 Support

- 60% Savings vs Monthly

Secure Payment Processing

All payments are processed securely through trusted payment providers. Your financial information is never stored on our servers.

Device Compatibility

Trade confidently on any device of your choice

Frequently Asked Questions

Common questions about Algomaxx Smart Pro

Get in Touch

We're here to help you on your trading journey.

Risk Warning: Trading financial markets carries risk. Past performance does not guarantee future results.